The following article may contain affiliate links or sponsored content. This doesn’t cost you anything, and shopping or using our affiliate partners is a way to support our mission. I will never work with a brand or showcase a product that I don’t personally use or believe in.

What is a credit score, and why do you need one?

You know when you go on a first (or third) date with someone, and they casually drop that they hate a movie you love, then proceed to trash said film, and you realize, “yeah, this isn’t gonna work out like ever.”

That’s sort of how I felt the first time I heard D*ve R*ms*y tell his millions of listeners that you don’t need a credit score. Except I was probably a little angrier than if he told me he hated Call Me By Your Name (which, let’s be honest, he probably does).

Advice that tells you a zero credit score somehow makes you a better person (???) or more financially savvy makes absolutely ZERO sense in our current financial landscape. It also completely ignores systemic inequity, which further marginalizes communities of color, women, and other minorities for whom a high credit score can open doors.

If you’ve been told that the best credit score is no credit score, here’s why that’s completely bonkers batshit advice and why you actually need a credit score.

P.s. If you are in the process of paying off high-interest debt, it’s 100% OK to be anxious to jump into using a credit card again. Personal Finance is personal, and there are ways to build your credit without getting deeper into debt –– but it’s important to do so with a plan.

What is a Credit Score?

The credit score was developed in 1989 (hey Swifties!), and was originally seen as a way to make sure banks didn’t discriminate. By creating this ranking of your “credit-worthiness” into a numerical index, banks were able to determine if you could, in their minds, handle more debt (and how much).

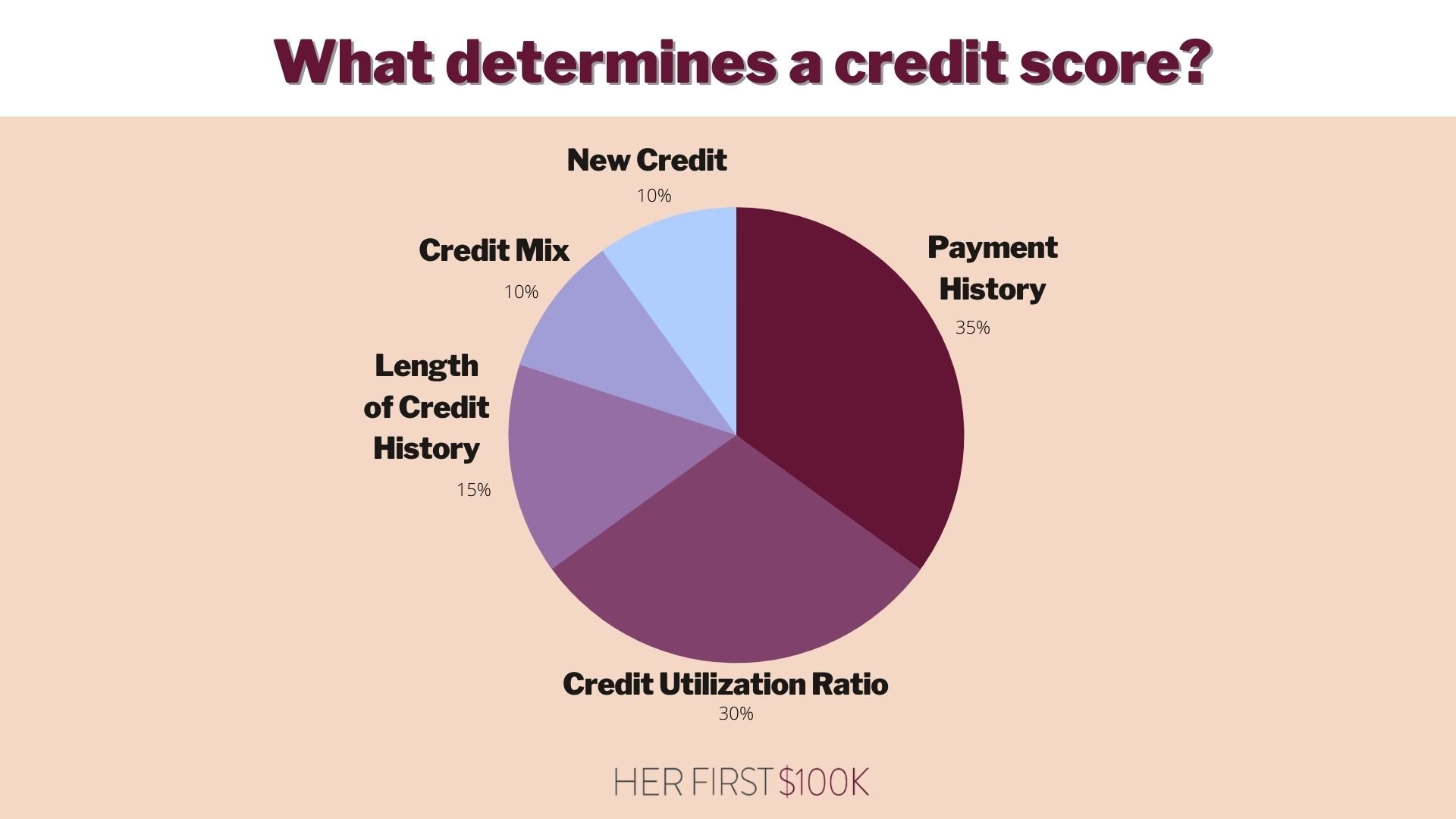

Your credit score has 5 factors that help the credit bureaus create your score:

-

10% New Credit: how recently you’ve opened new accounts

-

10% Credit Mix: what kind of credit lines you have open (credit cards, car loans, mortgages, home loans, etc.

-

15% History Length: how long your accounts have been opened

-

30% Credit Utilization Ratio: how much of your credit line you’re actively using

-

35% Payment History: how many payments you’ve made on time/in full in comparison to missed payments, collections, etc.

Each bureau is a little different, so you may see a slightly different score across them. This also illustrates why your score can jump or drop sharply when you open or close a credit account –– know that usually, things even back out, especially if you’re making on-time payments and keeping your credit utilization low.

Lower Interest Rates + More Access

Credit scores WILL get you lower interest rates. Whether you hope to one day buy a home, need to finance a car, or secure a loan of any kind, a higher credit score will help you get a better interest rate. In a perfect world, we’d never have to borrow money for anything, and credit scores wouldn’t be a necessity at all –– but that’s not the world we’re in.

Building your credit also can offer you better access to loans in general. If you have no credit (aka a 0 score), it’s significantly harder to prove to a lender that you are a “worthy” applicant.

Without a credit score, lenders will need to see an incredibly high income and years’ worth of paperwork and bank statements that back that information up. Even then, you aren’t guaranteed the lower interest rates that a high credit score can help you get.

A few percentages of interest may not seem like much with small loans. However, when it comes to the big stuff, like mortgages, even a half a point higher interest can mean thousands of dollars in additional payments over the lifetime of your loan.

Additional Savings

Because your credit score only looks at your debt to income ratio, not your level of income, it’s totally possible to use a credit card in moderation, pay it off every month, and have a high score even if your income isn’t particularly high. It’s another way of showing a bank that you can handle debts responsibly, which makes them more likely to approve your loan and often with better term offerings.

This is particularly helpful for low-income individuals and families accessing necessary utilities like wifi, electricity, water, and more. What many people don’t know, and unfortunately find out, is that utility companies will charge “security deposits” on these utilities if your credit is not sufficient.

These fees can be especially difficult tacked on top of the already expensive process of moving and setting up new services. This is what we mean when we say it can be expensive to be poor in America. With a good credit score, even if your income is lower, you may be able to avoid these extra fees.

An important note: this doesn’t mean that you’ll automatically qualify for any loan amount you want. Loans (except student loans, don’t get me started) are based on several factors, including income alongside your credit score. Many loan companies will not approve you for loans that exceed a certain debt-to-income threshold.

Other Perks and Protections

I don’t use a debit card. I don’t even have access to one. Instead, I make 100% of my purchases on a rewards credit card and pay my statement in full each month. This system works for me because overall, I have a good grasp of my spending and limits and a healthy savings and emergency fund.

Using my rewards credit card comes with so many incredible perks like travel rewards, points towards hotels, dining, and even cash back. Because I pay my bill in full at the end of each month, I never pay interest and get to reap all the benefits of my card simply by using it to buy what I’d spend money on anyways.

I don’t do the whole “credit hacking” that many personal finance creators promote (where you use several different credit cards in different ways depending on what you’re purchasing/how your rewards system works). You can start simple, with one card that fits your preferences. For example, I do a lot of travel and like doing so –– so I chose a credit card that offers more travel incentives.

Additionally, credit cards offer more fraud protection than debit cards –– and that gives me extra peace of mind as I spend.

Credit cards and credit scores are not your enemies. They’re also not a perfect system. Unfortunately, a bad credit score can take a lot of time and care to get out from underneath. That’s why I think it’s so important to keep talking about it and provide more consistent education on properly using a credit card as a financial tool.

Check out our recommended credit cards!

I get asked all the time: what are your favorite money management tools?

Treasury: We’re building a one-of-a-kind, non-judgemental community where you can learn exactly how to invest, build wealth, and receive exclusive access to Her First $100K.

Ladder: Try Ladder— a smart (and affordable) term life insurance option that offers personalized pricing and flexible coverage so you can protect your family with ease. It takes about 5 minutes to apply and to see if you’re approved. If you’re between 20-60, you can get up to $8M in coverage.

SoFi: Our recommended HYSA, SoFi, is a must for anybody trying to build their wealth. you’ll earn more interest in nine days than you would in one year in a big bank’s checking or savings account—so you can get the most out of your money.

Personal Capital: The tool I check daily, Personal Capital is the best tool for tracking your net worth and your progress towards goals like saving, debt payoff, and (yes!) $100K.

The $100K Club Facebook Group: Need some honest money conversations in your life? Join my free community to get your burning questions answered.