The following article may contain affiliate links or sponsored content. This doesn’t cost you anything, and shopping or using our affiliate partners is a way to support our mission. I will never work with a brand or showcase a product that I don’t personally use or believe in.

Choosing the Right Travel Credit Card

After a year of barely leaving my one-bedroom apartment (thanks, COVID!), I am more than ready to hop on a plane to a tropical paradise where I can sip a boozy beverage on the beach or bask in the warm glow of a bustling city at night.

If you know me, you know I don’t use a debit card for many reasons, but the feeling I get knowing that every swipe on my favorite travel credit card brings me closer and closer to another stamp on my passport has to be one of my absolute favorites.

I’m frequently asked which travel cards I prefer — so I’m comparing my top two to help you decide which card is best for you.

A NOTE: I only recommend applying for a credit card if you know you are able to pay them off on time and in full! If you feel like you are financially and responsibly able to do so, keep reading!

Card # 1: The Chase Sapphire Preferred Card

How does $1,000 towards your travels sound? That’s a round trip to quite a few tempting destinations or a few nights in a very glamourous hotel. (Room service? Yes, please! I’ll take the lobster.)

The Chase Sapphire Preferred Card offers 80,000 bonus points after you spend $4,000 on purchases in the first three months (roughly $1,000 in travel cash).

You’ll also earn 2X points on dining, including eligible delivery services, takeout, and dining out, as well as a point on every dollar you spend on other purchases.

Spending $4,000 in three months may feel daunting, but you’d be surprised to see how quickly small purchases add up!

A great way to make sure you hit your goal is to plan to apply for the card before big life events like weddings or pre-planned vacations. Treat your friends to a brunch on you! Invest in that new suitcase you’ve been eyeing! But PLEASE make sure you have the cash on hand to cover this when the bill comes.

Using credit cards can be incredibly lucrative, but you have to plan your usage strategically or you’ll just end up giving that $900 right back to pay your statement.

The Chase Sapphire Preferred card comes with a ton of great perks, like:

-

$0 delivery fees when you use DashPass by DoorDash. Some days, making a meal or finding time to run out for lunch just isn’t going to happen, and you can feel completely guilt-free about that with free deliveries on all orders over $12.

-

Trip Cancellation Insurance. Life happens, trips get canceled. It can cost you hundreds to cancel flights and hotels when last-minute changes come up, and traditional travel insurance plans can cost anywhere from 4 -10% of your entire trip. Chase’s built-in travel cancellation insurance can be reimbursed up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable passenger fares if your trip is canceled or cut short by covered situations like sickness or injury.

-

Enjoy benefits such as a $50 annual Ultimate Rewards Hotel Credit, 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining and 2x on all other travel purchases, plus more.

This card is great for all of my point-loving travelers out there, and Chase Unlimted Rewards is an excellent rewards platform. They offer incredible flexibility — like booking partially with points and partially with cash, so you can still take advantage of discounts even if you don’t have enough points saved.

You can also use your points at stores like Apple and Amazon, on gift cards at over 150 brands, and earn bonus points when you buy from any of the 350+ retailers on Shop through Chase — their online shopping platform.

Card # 2: The Chase Freedom Unlimited Card

Prefer cash to points and you’re not a fan of annual fees? The Chase Freedom Unlimited card might be for you.

Cashback rewards can be redeemed for credit card statement credit, purchases through participating online retailers at checkout, gift cards, or discounts on services or travel. It’s good to note that there are limits to where you can redeem your cashback — so keep this in mind as you consider this option!

The Chase Freedom Unlimted Card earns you 6.5% cashback on travel, 4.5% on dining and drugstores, and unlimited 3% cashback on all other purchases for your first year on up to $20,000 in purchases.

If you’re like me and put all of your expenses on a credit card that you pay off monthly, this card will reward you BIG time.

Plus, you get a $200 bonus if you spend $500 in your first three months. And your cashback rewards won’t expire as long as the account remains open. This is an excellent option if you don’t have the $4000 you need to maximize the rewards on the Chase Sapphire Preferred.

Did I mention there are no annual fees? That’s like reaching the end of the line at Chipolte and learning the guac ISN’T extra.

I enthusiastically recommend either of these cards as excellent options for travelers, so it all comes down to your preferences.

If you’re looking for rewards points, extra perks, and have the $4000 to spend to maximize your rewards, think about the Chase Sapphire Preferred card.

If you prefer no annual fees, cashback on most purchases, and are working with a smaller budget consider the Chase Freedom Unlimited card.

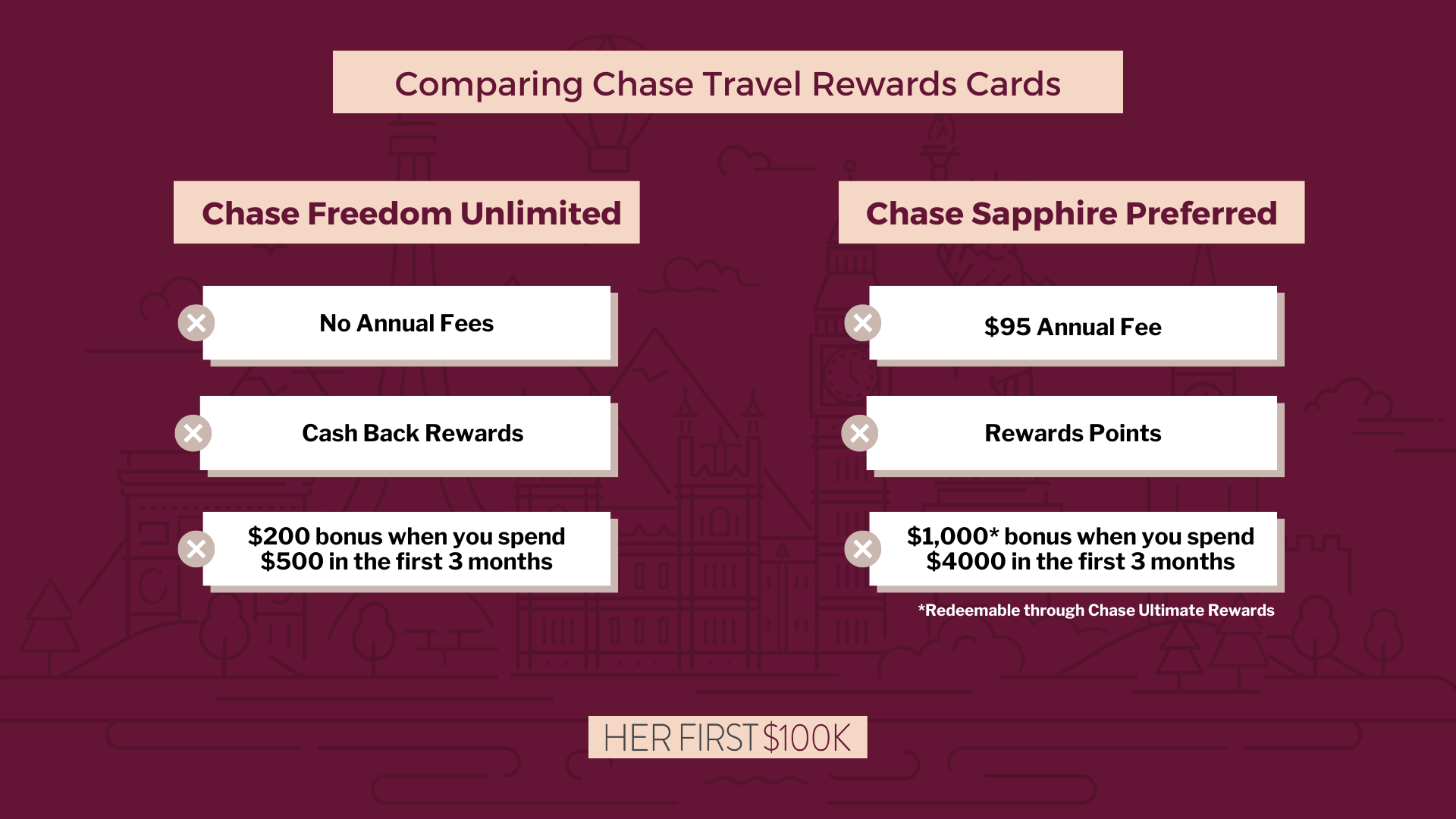

Here’s a chart for a quick side by side comparison:

HerFirst100k.com has partnered with CardRatings for our coverage of credit card products. HerFirst100k.com and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.