The following article may contain affiliate links or sponsored content. This doesn’t cost you anything, and shopping or using our affiliate partners is a way to support our mission. I will never work with a brand or showcase a product that I don’t personally use or believe in.

How Mental Health Affects Financial Wellbeing

We live in a society that is gripped by mental health – in a good way. From normalizing therapy and meditation podcasts, to embracing self-care and whatever mindfulness retreat that Gwyneth Paltrow is promoting, there has never been more information and resources available to help us better understand and promote our mental health.

But while we explore the relationship between our mental health and our physical, emotional, and social wellbeing, one relationship we feel is rarely discussed, yet particularly important to examine, is the relationship between our mental health and our financial wellbeing.

While our relationship with money and mental health are undeniably linked, financial stress and money anxiety disproportionately affect women, and are having a negative impact on our mental and physical health.

Today, we examine the relationship between women’s mental health and financial wellbeing and how the two can significantly impact our lives for better or worse. Plus, our team shares personal tips and strategies for mitigating life’s stressors so that we can live more peaceful, fulfilling, and healthy lives.

How money and mental health are connected

We have all felt the stress of checking a bank account balance, the adrenaline rush of making an impulsive purchase, or the pit in our stomach when we see “declined” after we swipe a debit card. It’s in these moments that we are hyper aware of just how closely our mental and financial health are linked and how managing personal finance can take a toll on our mindset.

It’s clear to see why money would create feelings of anxiety: not only is money necessary to provide for your essential needs, but we exist within a society in which money functions as a status symbol that is representative of your success. While we have to manage savings, paying off debt, budgeting for our bills, and planning for our financial future, we also spend a significant amount of time and energy worrying about what our income says about our value as a human being.

Just as our finances can impact our mental health, the state of our mind can also impact our financial wellbeing. According to the Money and Mental Health Policy Institute, people who struggle with depression are 4.2 times more likely to still have debt at 18-months compared to their counterparts without debt.

Additionally, impulsive spending is a coping mechanism used by many to distract from everyday pressures and reduce negative feelings. Not only does impulsive spending often result in overspending, but once the feelings of euphoria from the purchase wear off, spenders often experience intense feelings of shame and guilt. In order to reduce the feelings of guilt, impulsive spenders may feel compelled to shop, thus continuing the damaging cycle of emotional spending.

Hitting a little too close to home? If you want to learn how to break the cycle of emotional spending, sign up for my FREE course, How to Curb Emotional Spending!

While it is easy to feel isolated in carrying the emotional burden of financial strain, these feelings are extremely common. According to the American Psychological Association, 72% of Americans have experienced these money-related stressors at some point in their adult lives, while 56% went on to say that their debt was negatively impacting their life.

Why money anxiety disproportionately affects women

Despite the significant demographic that experiences financial stress, studies consistently reveal that women experience more money anxiety than men.

According to a survey in Women and Economic Anxiety, on a scale of zero to 100, women scored higher on an economic anxiety index than men. The survey also found that women were less likely to consider themselves to be “financially secure” and believe that the economy was strong, while being more likely to lose sleep over money anxiety.

There are a number of factors that could contribute to this high level of money anxiety in women:

-

A lack of financial resources

Historically, many financial resources were created by men and for men. The few resources that offered financial education to women often utilized shame-based tactics such as “stop buying lattes and avocado toast” rather than actionable steps that would adequately prepare women for a healthy relationship with money.

Her First $100K is here to change the way that women learn about money and career. Looking for financial resources & money tools that are judgment free, relevant to modern day, and sustainable for your lifestyle? Check out our library of products that will help you master your money, land your dream job, and prepare for your financial future; created for women, by women.

2. The gender wage gap

In 2022, the average woman will be paid only 82 cents for every dollar that is earned by her male counterpart. For women that work full time, this gender wage gap will result in a $10,157 loss of income and more financial strain on working women than men.

You can read more about misogynistic policies that affect women here.

3. More student loan debt

In the US, women hold 58% of all student loan debt, carry a total loan amount that is on average 9.6% higher than their male counterparts, and will take two additional years to pay off their student loans. Additionally, despite making an average of 18% less than their male peers, women are more likely to make higher monthly student loan payments.

In addition to putting financial stress on women, this student loan debt disparity ultimately holds women back personally, and financially, while continuing to perpetuate a patriarchal cycle that limits women’s growth and opportunities.

You can read more about how to reduce the financial impact of student loan debt on women here.

4. Unpaid parental leave

Only 21% of US workers have access to paid family leave through their employers, and Federal law guarantees new parents just six weeks of unpaid time off – not all workers qualify. With 54% of Americans living paycheck to paycheck, the financial burden of going six weeks without pay can be catastrophic to many mothers.

Additionally, many employers perceive pregnancy and parental leave as an inconvenience and financial burden, often resulting in biases against hiring mothers or women who plan to become mothers in the future.

These are just a few of the unique societal and economic challenges that face women and contribute to the overwhelming experience of money anxiety amongst women.

The long-term effects of financial stress and money anxiety

Stress has become highly normalized in our society of “busier is better” and “no days off” mentalities, and it is not uncommon to come across memes and TikTok videos joking about the inability to do our own taxes and not knowing what a 401(k) is. And while experiencing some financial stress is perfectly normal and expected, there comes a point in which our money anxiety may begin to severely impact our mental and physical health and overall quality of life.

According to an article by MoneyGeek, money anxiety can lead to chronic stress – stress that affects your mind and body for years. The effect of this daily stress extends far beyond the mental, and ultimately causes premature damage to your cardiovascular system, exacerbates mental health concerns, and can even affect the parts of your brain that are associated with Alzheimer’s syndrome.

Even occasional financial stress can contribute to intense feelings of anxiety and depression, frequent headaches, cause gastrointestinal distress, affect sleeping patterns, and impair a person’s ability to focus.

Not only do these symptoms affect our mental and physical health, but money anxiety can also keep us trapped in a cycle of financial insecurity.

According to the CDC, someone who is enduring the mental and physical symptoms of chronic money stress may experience more illness and affect their ability to go to work consistently. Even if they are able to show up to work, their focus may be impaired, ultimately resulting in a decrease in productivity, work performance, and the ability to bring in income.

Finally, women who are unable to break out of the cycle of money anxiety, emotional spending, and debt are less likely to proactively prepare for retirement, resulting in a lifetime of financial stress, limited financial freedom upon retirement, and potentially an inability to retire altogether.

How to break the cycle of money anxiety

There is no denying that financial stress can have a lasting negative impact on our mental, physical, and financial wellbeing. Fortunately, there are ways to break out of the cycle of financial stress and develop a healthy relationship with money.

Pursue financial competency

It may sound cliché, but we truly believe that with knowledge comes power. The more you learn and understand personal finance, the more confident you will become and the better equipped you will be to handle every financial curveball that is thrown your way.

Not sure where to start? We recommend checking out our bestselling book, Financial Feminist: Overcome the Patriarchy’s Bullsh*t to Master Your Money and Build a Life You Love, which is the perfect way to get a firm understanding of your money situation, create a financial plan, and get the ball rolling on reaching your money goals.

Start investing and preparing for your financial future

One of the areas we see women experience the most anxiety is investing. Whether it is the finance-bro jargon, the industry-specific terminology, or the perceived threshold to entry, many women avoid investing altogether out of intimidation and anxiety.

The unfortunate reality is that, in this day and age, studies show that you will not be able to retire without investing, so putting off investing due to anxiety will only cause you more financial strain and anxiety come retirement age.

Here at HFK, we believe that investing does not have to be complicated or intimidating. In fact, we have helped women invest over $10 MILLION in the stock market through our investing education platform, Treasury!

Treasury makes it easy to start investing by providing you with all of the resources and information you need to understand the fundamentals of investing without any of the Wolf of Wall Street jargon and intense, masculine energy. Plus, Treasury has a unique community element that allows you to engage with other investors and see where they are investing their money.

If you are ready to start investing and building your financial confidence, sign up for our upcoming Investing 101 Workshop. This will be your investing crash-course so you can gain full access to Treasury and start navigating the stock market and preparing for your financial future with confidence!

Practice mindfulness and self care

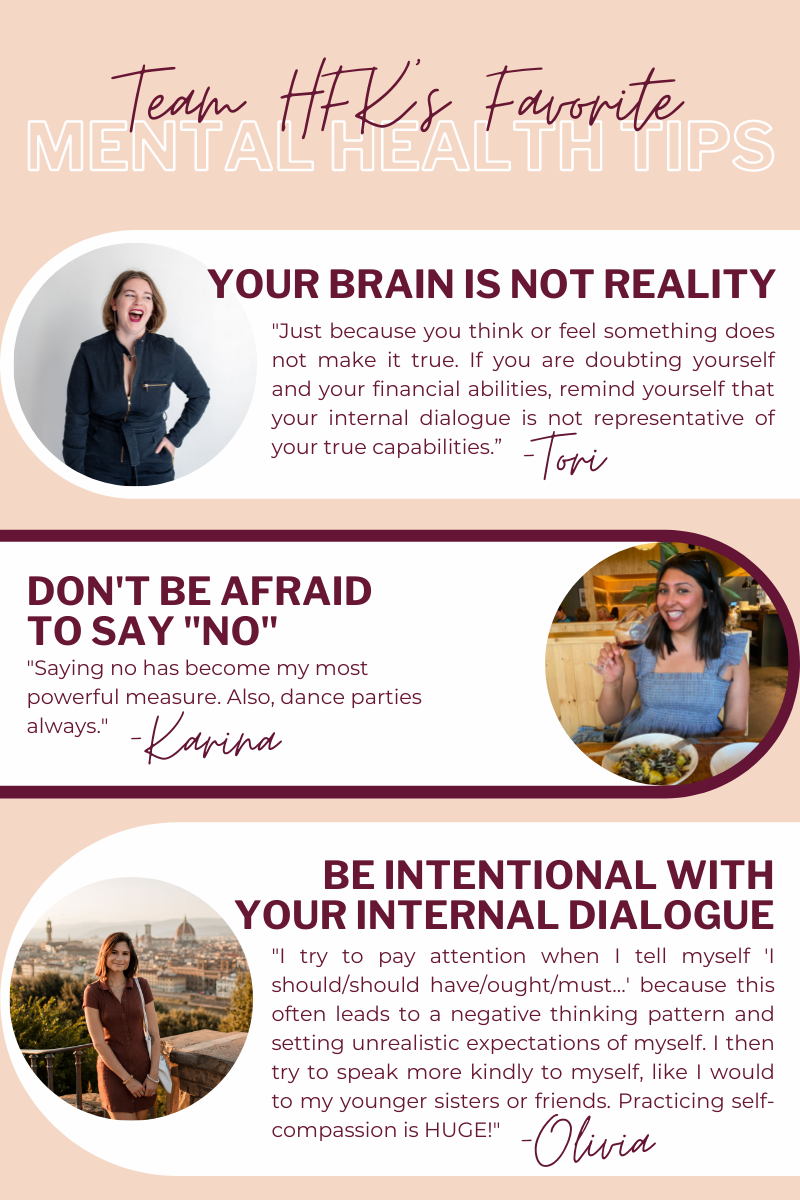

The Her First $100K® team is made up of people who LOVE to talk about money, but many of us used to experience intense feelings of money anxiety. So, we are sharing our personal tips and strategies to overcome feelings of financial stress, promote a sense of mental wellbeing, and approach our personal finance with confidence and capability.

A note: we are not mental health professionals. These are methods that we personally use, which may or may not be appropriate for your situation and needs.