Warning: this is not another article telling women to be more frugal.

The world has enough (actually way more than enough) articles with tips on how to pinch pennies and spend less money.

I’m not concerned with how much you spend—I’m concerned with how much your spending aligns with your values.

Are there times we all want to reel in our spending? Sure.

Does your budget have a finite max? I’m going to make an assumption here and say you’re not a billionaire, so yes.

But is spending less the ultimate goal? Not necessarily.

I don’t want you to spend less money. I just want you to spend less money on stuff you don’t care about.

What most money articles get wrong is that you don’t need to villainize all spending. Doing so only starts you on a cycle of deprivation, shame, and guilt. And it doesn’t help your budget in the long run. It’s the juice cleanse of money advice.

Instead, try to make small shifts to make sure your budget follows your bigger goals.

Here are 5 tiny tips to help you improve your spending habits:

1) Create value categories.

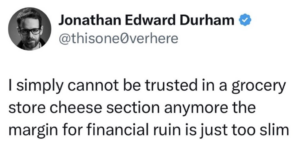

Anyone else relate to this? 🤪

You start off thinking you’re going to make a cute lil charcuterie board and then three baguettes and one too many gourmet cheeses later, you’re like, where did the money go??

Here’s how I’d handle this. Yes, seriously!

I’d determine if cheese is a value category.

I go into more depth about value categories in my book (there’s a whole chapter on spending!), but the basic idea is that you pick three categories of your non-essential spending to prioritize.

You give yourself the freedom to spend money on these things because 1) depriving yourself of everything sets you up for failure, and 2) money is a tool meant to help you build the life you want to have. So, if you want cheese, go for it!

Cheese probably isn’t the value category itself–maybe it’s hosting friends and cheese is just a majorly delightful part of that. But you get the idea.

2) Look for upstream habits that lead to extra unintentional spending.

What kind of habits?

Things like:

- Scrolling FB marketplace

- Clicking through emails from your fav athletic wear company

- Browsing Mercari/Poshmark/etc.

- Checking out concert tickets for your local theater

Of course, if these things are part of your value categories, go ahead, you have my blessing!!

But if you find yourself looking back and thinking, I really didn’t need that pair of boots, give it a try. It’s easier to stop scrolling than to convince yourself that you don’t need that new jumpsuit/vintage jacket/chaise lounge once you find it.

Unsubscribing (yes, sometimes literally) may mean freedom from one more source of temptation.

3) Identify money sinkholes.

What’s a money sinkhole?

It’s a place in your budget where money seems to magically disappear. One minute, it’s there, the next, it’s gone.

Cash is a common one. You decide to get a few bucks for the farmers market and end up taking $100 out of the ATM. Next thing you know, the cash is gone, but you can’t say where it went. Your gorgeous bouquet and bottle of local honey are nice, but not THAT nice. Another example might be Venmo.

You see the transactions in your account without remembering what they were really for. Sure, you could match your transactions to your Venmo history (if you can remember what “IYKYK 🤠🥜🏆 ” means), but you probably won’t.

Nothing against cash or Venmo–but be on the lookout for places where money disappears.

When you don’t know where your money goes, you don’t know if your spending reflects your values. And that’s rule #1 of intentional spending.

No need to try to “fix” anything immediately. Just become aware.

4) Create a fun budget.

What goes in this fun budget?

It could be…

- Books

- Shows

- Dinners out

Or it could be escape rooms, knitting supplies, or scuba diving trips. Whatever you want.

Why create a fun budget?

Too often, people tell me that they don’t like budgeting. They feel guilty spending any money at all, or they avoid budgeting because it feels too restrictive.

I tell them that you should be able to enjoy spending money on things that matter to you and with intention. I’m not saying you can magically justify that $150 Anthro candle (maybe?), but rather, you get to make choices that align with your values and budget.

And often, when you give yourself this room, you realize it’s not so hard to stick to a plan. So give yourself free rein for some fun. Your budget might actually thank you.

5) Look for ways you spend money to cope.

I talk to a lot of people who want to feel better about their spending. There are three options when this is the case:

- You want to change what you spend money on

- You want to change how you feel when you spend money

- You want to change both

If you really do want to change what you spend money on, look for ways in which you use money to cope and don’t get anything out of it.

I’ll never shame you for spending money. Nah.

But if you go on a mini shopping spree every Sunday night to cope with the Sunday scaries, I’ll offer that maybe that spending isn’t doing you a ton of good.

As always, whether your spending is useful is up to you. But it doesn’t hurt to reflect on it.

Remember, you don’t need to change everything.

When you realize that your money satisfaction is influenced as much by how you feel about your money as it is by the concrete choices you make, even small shifts can drastically improve your money management.

You don’t need to cut your spending to be “good” with money. Instead, focus on creating an intentional budget that gives you room to use money as the tool that it is.