The following article may contain affiliate links or sponsored content. This doesn’t cost you anything, and shopping or using our affiliate partners is a way to support our mission. I will never work with a brand or showcase a product that I don’t personally use or believe in.

Essential Tax Day Tips

You know that classic saying time flies when you’re having fun?

While this may be true, we have noticed that time never flies faster than when you are actively procrastinating on filing your taxes.

April 18 is the 2023 deadline to file your taxes, and it is coming up QUICK. So if you have been watching the newest season of Outer Banks (or rewatching it a couple of times – no judgment here) to take your mind off the fact that you haven’t filed your taxes yet, take this as your gentle reminder to get started!

But don’t worry; we are making this tax season easier than ever by giving you the Tax Day tips you need to streamline your filing process, maximize your tax return, and proactively prepare for next year’s tax season!

Be Prepared

Listen, no one enjoys filing taxes.

Okay well maybe somebody enjoys filing taxes, but we haven’t met them and aren’t expecting to anytime soon.

Filing your taxes can be time-consuming and stressful, so going into filing with preparedness is one of the best ways you can make the process as smooth and painless as possible.

Set aside plenty of time to file so you don’t feel rushed, put on comfy clothes, have your favorite snacks on hand, listen to calming music, and make a plan to reward yourself with some ice cream and quality Netflix time once you have finished filing.

Stay Organized

Doing your taxes can require a lot of paperwork, so it is important that you have all of your essential documents ready before you file. This will ensure that you have all the necessary information you need to successfully file your taxes as well as take advantage of every possible deduction you are qualified for.

The required documentation will differ based on each person’s sources of income and expenses, but necessary documents can include:

-

Your social security card or tax ID number

-

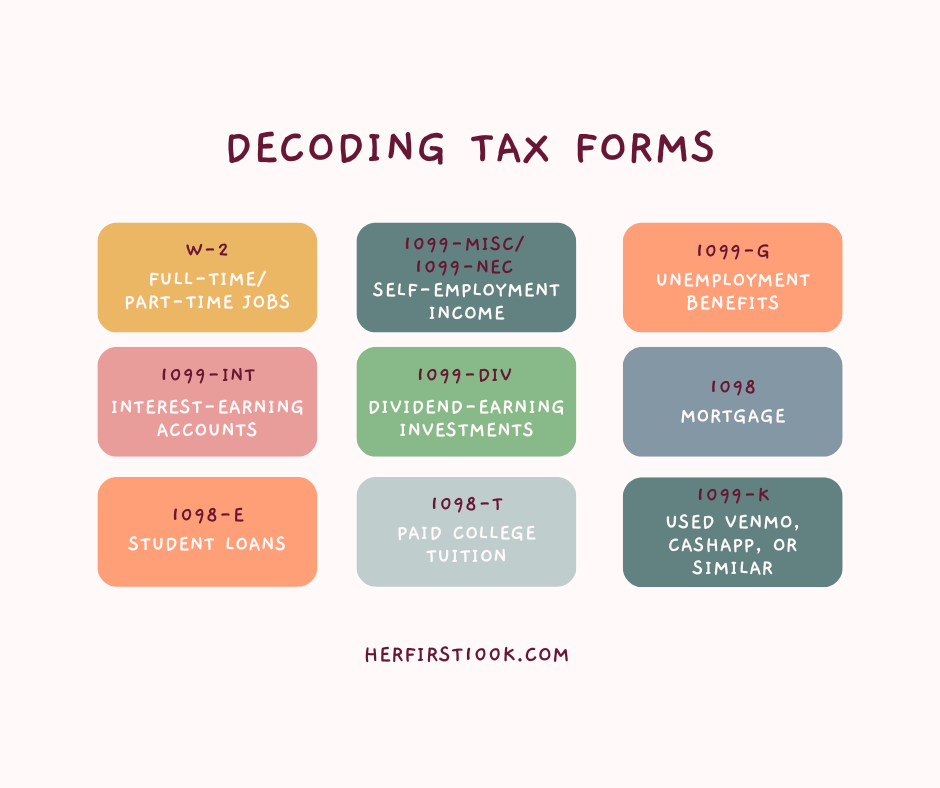

Forms W-2, Forms 1099, and other forms that record income earned

-

Documentation of charitable contributions

-

IRS Letter 6475 AKA record of your 2021 Economic Impact Payment

-

Receipts or other documentation of business purchases

-

Records of childcare and medical expenses

-

Records of mortgage interest and paid property taxes

This article from TheSkimm provides a really helpful breakdown of the various tax forms you may need during the tax filing process.

Once you have completed your taxes, make sure to keep this paperwork organized in a safe place so that it is easily accessible on the off chance that an issue with your taxes arises.

Reduce Taxable Income

That’s right – even though you only have a few days left before tax day, you still have time to reduce your taxable income by contributing to tax-advantaged accounts such as an IRA or an HSA!

Not only are these accounts extremely important for preparing for your financial future, but contributions made to them are exempt from the current year’s taxation. So, by maxing out your contributions, you will effectively reduce your taxable income and ultimately pay less in taxes.

In a calendar year, you can contribute up to $6,000 to an IRA and up to $3,600 for single coverage or $7,200 for family coverage in an HSA, thus reducing your taxable income and also preparing for your financial future!

Can’t afford to max out these accounts right now? Don’t have an IRA? That’s okay! Use this time to figure out how you can take advantage of these accounts and tax benefits for next year.

Be Aware of Tax Scams and Frauds

In recent years, it has become increasingly common to receive phone calls, text messages, emails, or messages via social media from entities claiming to be the IRS. In fact, these scams have become so common that the IRS publishes a list every year of the most common tax scams so that we can all be more aware and avoid becoming a victim.

As a general rule, the IRS will only communicate with you via the US Postal Service unless you go into litigation, so any digital communication you receive from anyone claiming to be the IRS is a scam designed to gain access to your personal information or funds.

If you receive a message or phone call that you suspect is a tax scam, you can file a report by sending an email to the dedicated IRS email hotline for tax scams (phishing@IRS.gov).

Create a Plan for Your Tax Return

Did you really think we wouldn’t mention budgeting your tax return??

Come on, we couldn’t rightfully consider ourselves a financial education platform if we didn’t encourage you to use your tax return intentionally! Your tax return is a valuable financial resource, and having a plan for how to use it will help you reach your larger financial goals and prevent impulsive spending that doesn’t align with your values.

There are a number of ways that you could use your tax return in order to maximize its financial impact. One of our personal favorites is using it to invest in the stock market. This not only helps you grow your wealth and prepare for your financial future, but it also is one of the most significant ways that, as women, we can make strides toward achieving financial equality.

Now we know that investing in the stock market is one of the only things that can feel MORE stressful than filing your taxes, so we are making investing easier than ever through our Stock Market School.

With a focus on transparency and accessibility, this interactive investing school teaches you how to invest in the stock market without the finance-bro jargon and toxic Wolf of Wall Street energy that can often be intimidating to aspiring investors. Additionally, it has a unique community element that allows users to engage with other like-minded investors and see where others are investing in real-time.

If you want to use your tax return to get started with Stock Market School, register to join our next cohort! Not only will this workshop grant you full access to the Stock Market School community and Treasury web app, but it will also teach you the investing fundamentals you need to make the most of the platform and your tax return!

And while we here at HFK are BIG fans of using your tax return to invest in the stock market, we also highly encourage you to treat yourself to a little something special too. Taxes are hard – you deserve a reward for getting through them!

Prepare for Next Year’s Tax Season

We know, we know – at the end of filing your taxes, the LAST thing you want to do is think about next year’s taxes. But this is the perfect opportunity to start planning for next year’s tax season so that the process will be easier and more streamlined than ever!

If you encountered certain pain points while filing your taxes, consider how you could avoid them for next year. Whether this looks like having a better organizational system or using a tax professional, the sooner you have a plan in place, the easier next year’s filing process will be.

If you are a small business owner, you know firsthand how challenging and time-consuming it can be to file your taxes if you don’t have a dependable system in place.

One of the easiest ways to simplify your tax filing process is by having a business credit card. This will keep your business purchases organized so that you can deduct the maximum amount of business-related expenditures come tax time.

We have compiled a list of our absolute favorite business credit cards that will not only help you earn awesome points and perks for your business purchases but will also help make next year’s taxes a little easier.

I get asked all the time: where do I start?!

Take my free money quiz for a step-by-step plan with actionable resources to meet you at each stage of your unique financial journey.