The following article may contain affiliate links or sponsored content. This doesn’t cost you anything, and shopping or using our affiliate partners is a way to support our mission. I will never work with a brand or showcase a product that I don’t personally use or believe in.

Short term vs. Long Term Savings Goals

If you’re like me, you’ve been told to save money since you were young –– whether from parents, guardians, teachers, or even mentors. You might have even had a cute little piggy bank or maybe a special box you carefully collected your earnings.

For me, it was an Altoids tin. I stashed away my pennies and quarters and the occasional bill religiously away in this small flip container. I remember sitting in the back of my parent’s car on the way to see Annie (I saved for months to buy my ticket), realizing that I had left my tiny tin at home and absolutely losing it in the back seat. I tell the full story of my first savings memory on the Psychological Bullshit episode of the Financial Feminist if you’d like to hear how this moment truly affected every money decision I made growing up.

Listen now: Overcoming Your Psychological Bullsh*t Around Money

We know that it’s good to save money, especially if we want to buy things. Growing up, those things might be concert tickets or a new pair of shoes, and as we get older it’s vacations and weddings and houses (and tbh, still sometimes a pair of shoes and concert tickets).

We’re not always given the best guidance though on how to save for the things we want, so here’s a quick guide to saving to help you build the best plan for you and your money.

Timelines matter

Before we get started on the methodologies behind savings, it’s important to remember that timelines are individual. You are not bound to anyone else’s life choices, and you can decide to take a different path than the one you’re expected to follow.

Just a few years ago, my biggest goal was saving $100,000 by age 25. I thought that I would be doing that and climbing the corporate ladder –– and I did save my $100K, but soon realized that corporate was not for me. This changed my timeline and my goals and that’s OK!

I share this because we humans are mercurial –– the only constant in life is change. We change and grow as new opportunities are presented to us. The best thing we can do for ourselves is check-in and make sure we’re following the life path we’ll be proud of when we reach the end of the road.

Alright, philosophical Tori is leaving the building –– let’s get into the most effective ways to save money!

What do you REALLY want?

Right around the time you start to settle in post-college or a few years into your career, you start to notice just how much of your paycheck is going to rent. You might start thinking “is it time to buy a home?” or “am I wasting money on rent?”

There are about 100 other examples of “should’s” you can trade out in this scenario. Is it time to start investing? Should I start saving for a wedding? Should I be saving for a vacation? A new car?

With social media keeping us so connected and aware of what others have (and don’t have), it’s easy to slip into the mindset that you’re lacking something. Most of the time, we don’t interrogate those thoughts too much, because it’s easier to just “go with the flow” than to actually figure out what it is we really want.

So here’s my question: what do you REALLY want?

Do you really want to buy a house? Just because all your friends are spending their weekend weed whacking and cosplaying Chip and Joanna doesn’t mean that’s all there is for you.

Do you REALLY want to spend $40,000 on a wedding? Or do you feel like you have to invite everyone you (and your parents) have ever met because it’s what’s expected?

Do you actually want to buy a brand new car? Or are you just self-conscious about your 2008 Honda Accord that’s seen better days?

It’s TOTALLY OK if you answered yes to any of these questions. Just remember this is your one precious life, and you get to decide what actually matters to you.

A helpful and effective way to save money is the classic pro-con list, especially one that factors in the future. What will you have to give up to save for whatever it is you feel you need to save for? Is that worth it?

At the end of the day, only you know that answer.

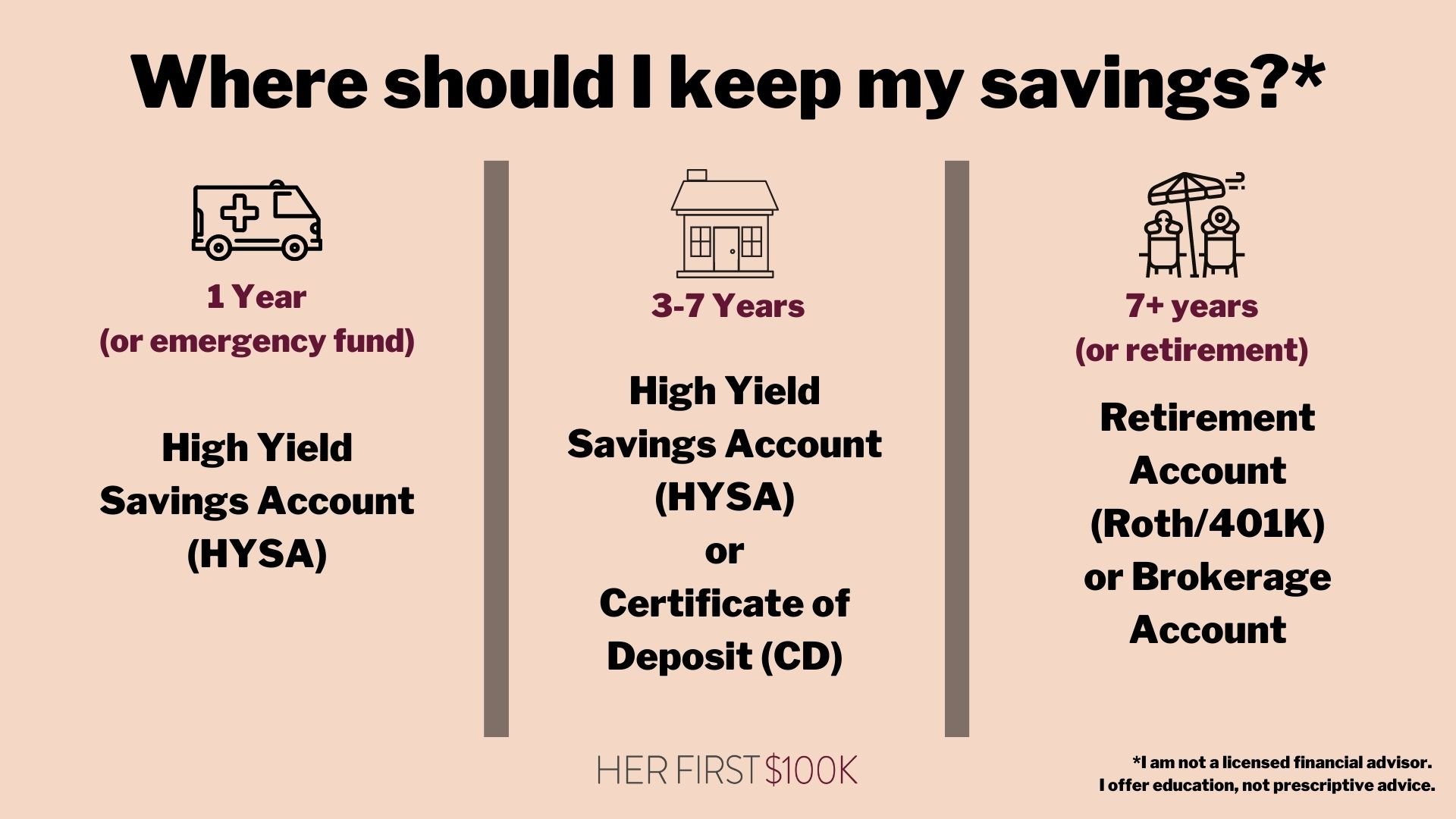

Where should you keep your savings?

So now that you’ve decided what you’re saving for –– where should you keep that cash?

Timeline: 0-2 years

If you anticipate needing to hack into your savings anytime in the next three years (this includes an emergency fund), I recommend keeping this cash in a HYSA over a regular savings account. There are no penalties for withdrawing (unless you’re doing it several times a month), and your money will grow at a faster rate (almost 50x the interest compared to your bank’s savings account).

Timeline: 1-7 years

If you’re planning a vacation, saving for a downpayment, or other life events that will occur sometime in the next 1-7 years, you may want to consider a CD (otherwise known as a certificate of deposit). These accounts are offered by most banks, and have a higher interest rate in exchange for the requirement of leaving the funds in place for an agreed-upon amount of time (ie; 18-months).

These are NOT the best accounts to use for emergency funds since you need to be able to access those quickly and without penalty when an emergency occurs. Make sure you read the full terms and that you are able to keep that cash in place for the duration of the set term.

Timeline: 7+ years or Retirement

If you are saving for something at least 7 years out, it might be time to consider investing it. No HYSA will ever be able to touch the rate of returns that the stock market will give you, especially over a long period of time. A traditional brokerage (not retirement) account is a great place to start!

If it’s retirement you’re saving for, then you DEFINITELY need to consider a retirement account like an IRA. Keep in mind, with retirement accounts like IRA’s and 401K’s, you will pay a penalty if you withdraw them before a certain age (currently 59 ½).

Should you be saving, or should you be investing?

If you grew up with a super saver mindset, you might be feeling a little panic right now about splitting up your savings account and finally investing your hard-earned money. It’s totally normal to feel nervous about investing –– but keeping all of your savings in an HYSA or even a CD for decades on end will hinder your ability to build real long-term wealth.

Some reminders if you’re feeling anxious about making the leap:

-

The stock market has averaged 10% returns for almost 100 years.

-

The longer you invest, the more you take advantage of compound interest and will be able to weather any market boom or bust.

-

Women specifically lose one million dollars over their lifetimes by waiting longer to invest.

You don’t have to start with a lot. $50 a month over the course of 30 years at a 7% return is over $58,000 ($18,000 contribution + $40,000 in interest). You simply cannot afford not to invest.

Whatever your savings goals are, I hope this was a helpful breakdown for you of where to start. Remember, emergency funds come first (and are non-negotiable) –– from there, the world is your oyster!