Ever wish you could get a simple answer to your complicated money questions?

Most people I talk to didn’t get a lot of money education growing up, and sometimes, Google just doesn’t cut it. Which is why I love answering your questions!

Today I’m sharing my answers to 5 of your most commonly asked money questions. Here’s what I’ll cover:

- “How is my credit score calculated?” Plus why you need a credit score in the first place.

- “How can I pay off debt and build my savings with a pretty low income?” It does matter that you start now.

- “Do I need a financial advisor?” Who does, and who does not.

- “What can I do to be financially prepared to help send my kids to college?” Get a breakdown of relevant accounts, too.

- “What do you do when you have a windfall?” Rare, I know, but I can help you use it wisely!

(As always, this is not financial advice, and you should make your own choices based on your personal situation.)

“How is my credit score calculated?”

Why do credit scores feel like your adult GPA? Maybe because they are?

Credit scores can help you:

- Get lower interest rates for things like mortgages and car financing

- Gain better access to loans in general

- Improve application for things like apartments

- Get better car insurance rates

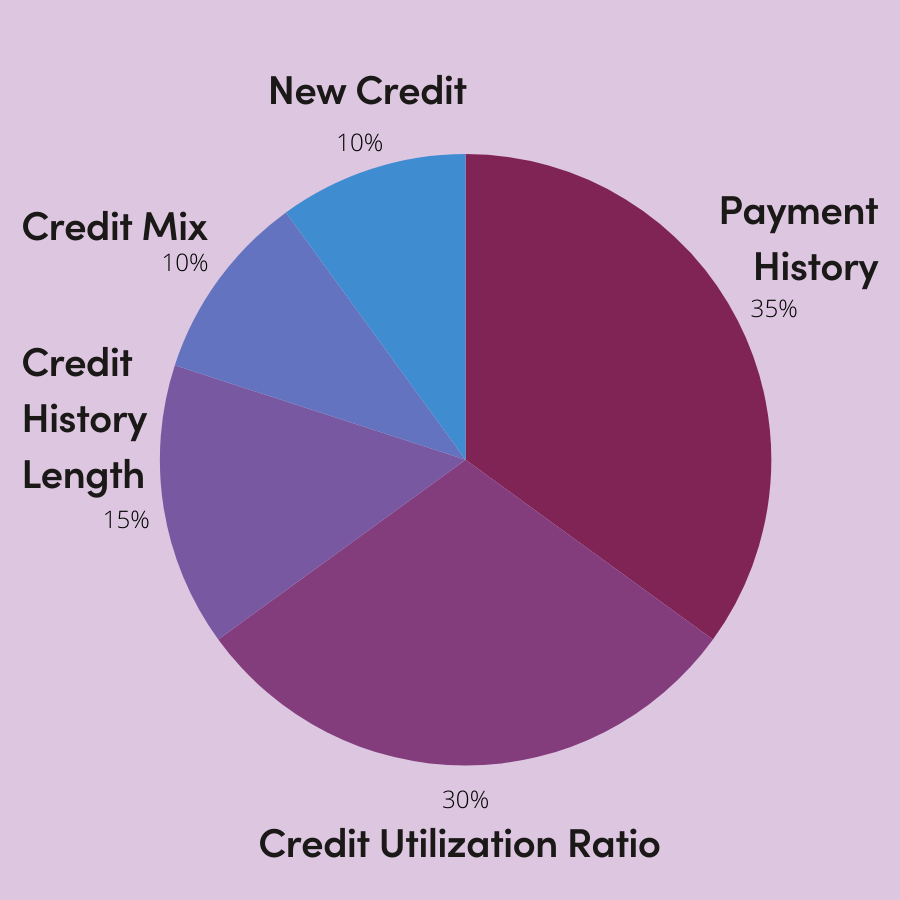

Here’s your score at a glance:

While having a high credit score can give you financial benefits, I want to pop in a quick reminder that credit scores are not an indicator of morality. You’re not a “good” person for having a “good” score, just like you’re not bad if you have a bad one.

For the full breakdown, read my guide to understanding your credit score and listen to this podcast on How to Increase Your Credit Score.

If you’re looking for a new card yourself, you can see my favorite credit cards here. I use mine to maximize my wanderlust and get cashback, and you can see what I recommend based on your personal needs, too.

“How can I pay off debt and build my savings with a pretty low income?”

Your number one financial priority is building an emergency fund (3-6 months of living expenses in a high-yield savings account). So when you’re thinking about prioritizing any sort of financial goal, especially if you’re lower income, make sure you have this down before you do anything else.

Whether you have student loans, a mortgage, or credit card debt, the key to paying off your debt quicker is contributing toward your principal.

As a reminder, the principal is the original amount of money you borrowed. So if you took out $10,000 of student loans, that’s the principal. The interest is everything that’s on top of it or the cost of taking on debt. Think of interest as the fee or percentage you pay to get that money from somebody.

Now, why do we want the principal balance to go down? Well, because we pay less in interest, right? If we can get the original balance to go down, then we don’t have to pay as much in interest.

My top suggestion for the debt pay-off goal is to start small. Set up an automatic transfer, even if it’s $20 a month, from your checking account to 1) your highest-interest debt or 2) a bank account that you use to distribute to your debt if you need to make different minimum payments.

Why start small? First of all, it will add up over time.

Second, you’re building your savings muscle. You’re getting more comfortable saving money so that when you do make more and have some flexibility, you have this routine.

My next suggestion would be to find ways to make more money so you do have more room in your budget to pay down that debt.

I know, that’s a hard ask, and it’s not possible for everyone. I wish there was a silver bullet to pay off debt or a secret I could tell you, but there isn’t. Most people who pay off large amounts of debt quickly already have high incomes or find ways to increase their income. But even if you don’t do it quickly, you can do it over time.

“Do I need a financial advisor?”

For 99% of people, the answer is no.

Who DOES need a financial advisor?

- You make millions of dollars a year and need help keeping everything organized and staying up to date on how to approach taxes, investments, etc.

- You have complicated finances (say you inherit a complex family estate).

- You won’t do the things you want and need to (aka investing, saving for retirement, etc.) without help.

Why don’t most people need a financial advisor?

You can manage your finances yourself. Unless you fall into those three categories above, you are totally able to do it.

I know when you first start putting more effort into your finances, it’s easy to feel overwhelmed. There are more new terms and trendy buzzwords than pumpkin spice lattes during spooky season.

BUT learning “how to money” is like learning any other skill. Little by little, you’ll understand more. And while you can go super in-depth with personal finance, most people aren’t worried about investing algorithms or backdoor Roth IRAs–they just need the basics.

Not to mention that when it comes to investing specifically, the pros aren’t always better than the market. When it comes to investing, professionals don’t always beat the market. Morningstar found that only 47% of actively managed funds outperformed passive counterparts. Excuse me?!

On top of all that, managing your own money keeps you engaged with your finances.

“What can I do to be financially prepared to help send my kids to college?”

I love a planner! Let’s talk 529s and some more context for you to think about as you decide what’s best for your family.

First, an overview of relevant accounts:

- 529 Accounts – a tax-advantaged savings account to be used exclusively for educational purposes

- Does apply to trade school

- Tax-advantaged benefits

- Can transfer to another person

- Can open as many accounts as kids or set up an account and change beneficiary after birth

- UTMA/UGMA Accounts – custodial brokerage accounts named after the Uniform Gifts to Minors Act (UGMA) or the Uniform Transfers to Minors Act (UTMA)

- Funds can be used for anything, not just education

- Available to the beneficiary (in this case, child) once they turn of age (dependent on state)

- Can’t be switched to another person

- Not tax-advantaged

Second, here are some questions to ask yourself:

How much of your child(ren)’s education do you intend to cover?

With the assumption that high college inflation rates will only continue, in 20 years, tuition could be more than $40,000 for a public 4-year university and $100,000+ for private. Even if you can reasonably expect investing gains on the money you contribute, that’s an astounding amount of money.

Being able to cover 100% might be impossible, so instead, consider how much you want to be able to contribute.

Do you expect your child to go to college or trade school?

I know I’m asking you to predict the future. And while you can use 529 accounts for a variety of education expenses, it must go to education or be subject to penalties and taxes.

Have you covered your own retirement needs?

I LOVE that you’re already thinking about how to set up your kiddos for college, but I have to emphasize that you need to put your own oxygen mask on first.

Your kid can borrow money for their education, but you can’t borrow money for your retirement.

“What do you do when you have a windfall?”

A money windfall could be an inheritance, profit from selling a house, or other influx of cash.

Here are some first steps:

- Fund or build up your emergency fund

- Pay off credit card debt

- Invest for retirement

- Pay off lower-interest debt

No debt and feel happy with your retirement setup? Consider your goals. Do you have any life changes or major goals this money could support?

If you have something you’d like to use the money for in the short term, I’d put the money in a HYSA. What’s the short term? That could be within the next 7 years since that’s how long it generally takes to recover if the market does take a downturn.

For example, you know you want to buy a house in the next year or so, but you’re not ready to buy just yet. While you’re still cruising Zillow like it’s your second job, keep your money in your high-yield savings account (HYSA) or a certificate of deposit.

If you don’t have a short-term goal, then I’d put it in the stock market.

The reason you wouldn’t put it in the stock market is there is more risk when you plan to take out your money in the short term. Remember, investing is a long-term strategy. On average, it takes the stock market about 7 years to fully recover from something like 2008. So for goals that are less than 7 to 10 years out, your HYSA or certificate of deposit is the way to go–just depends on the interest rate.

Finally, I want to acknowledge that if this windfall is an inheritance of some sort, you might have some complicated emotions about this money, and that’s totally normal.

If you’re in the thick of grief, it’s okay to take time to process and deal with your emotions first. Yes, you want to make a plan for the money, but you can’t make the decisions you need to without taking care of yourself.

Final Thoughts

While these questions are common, the decisions you make for your money will be totally unique. Everyone has a different set of circumstances and goals for their money.

My answers are here to help you get additional info and provide context for YOU to make your decisions. After all, I know you’re totally capable. ✨